Start an Idaho LLC

You can start your Idaho LLC by filing a Certificate of Organization with the Idaho Secretary of State. Our Company Formation Service includes your formation filing, as well as a year of our registered agent service. After that, we only charge $35 a year to be your registered agent.

Our $35 Registered Agent Service saves our customers an average of $150 a year. A lot of the other guys offer to form your LLC for cheap, only to hit you with hefty registered agent service fees after your first year. We only charge you $35 a year, every year as your registered agent. And if you hire us to form your LLC, even better! We’ll form your LLC with the state, act as your registered agent for a year, and give you everything you need to immediately establish an online business presence at no additional upfront cost.

What our Idaho LLC Formation Service Includes

Hiring a registered agent to help form your Idaho LLC not only saves you time, but it’ll save you money in the long run, too. Our Idaho LLC formation service does more than just register your business. It also includes:

- One year of our registered agent service

- A usable Idaho business mailing address

- Online account to monitor, track, and view important business documents

- Business domain (free for 1 year)

- Business website, email, and phone service (free for 90 days)

- Instant document delivery system

- Free operating agreement, membership certificates, and more

- Privacy by using our address on formation documents

- Real-time annual report reminders

- Lifetime client support, including help with certain federal requirements, like getting an EIN

Many company formation services aren’t transparent about what they charge. When you hire us, here’s what you’re paying for:

| Service | Fee |

| Idaho State Filing Fee | $104 |

| Our LLC Formation Service Fee | $100 |

| One Year Registered Agent Service | $35 |

| Enrollment in our Renewal Service | No Upfront Charge |

| Idaho Business Identity | 90 Days Free |

| Total | $239 |

Do-It-Yourself Idaho Incorporation

We’re happy to form your Idaho LLC by filing a Certificate of Organization with the Idaho Secretary of State on your behalf, but we also respect the independent Idaho spirit that we and so many of our clients share. If you’d like to file your LLC’s Certificate of Organization on your own, we’ve written this guide to help you do just that.

Before you can file your Certificate of Organization for your LLC online, you’ll need to create a free account with the Idaho Secretary of State. All you need is a valid email address. You can create your account here.

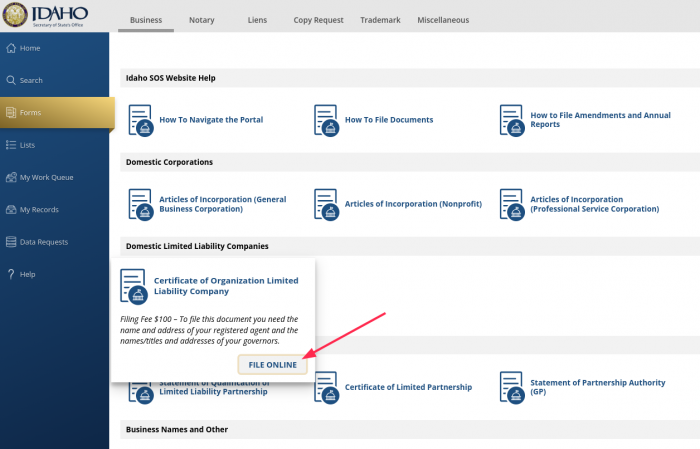

Once you’re inside your account, click on the “forms” button, select the Certificate of Organization filing (highlighted below), and you’re ready to begin your application.

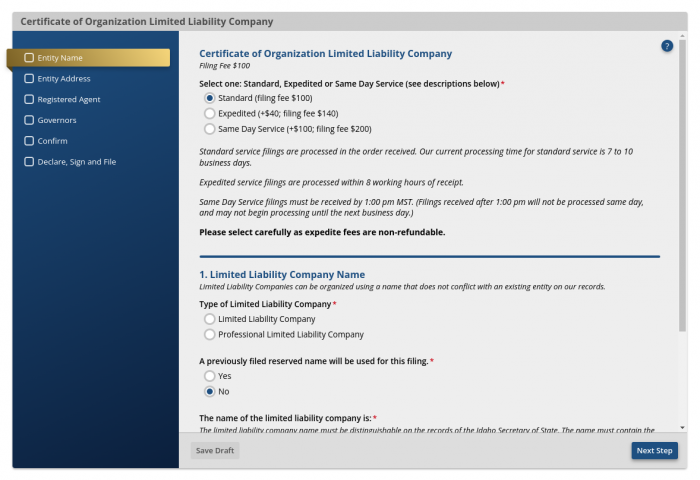

1. Name your Idaho LLC

First thing’s first: pick a name for your LLC. This may not be as easy as it seems. Idaho law, § 30-21-301, lays out the rules for naming your business. The name you choose needs to:

- Be different from any other business registered in Idaho

- Include the words “Limited Liability Company” or an LLC designator (like LLC or L.L.C.)

- Be free of any language that falsely states or implies your LLC is affiliated with the government or is a different entity type (like “Inc.”)

Luckily, the state of Idaho makes it easy to look up current business names with their business search so you can adjust your LLC’s name accordingly without having to re-file your Certificate of Organization.

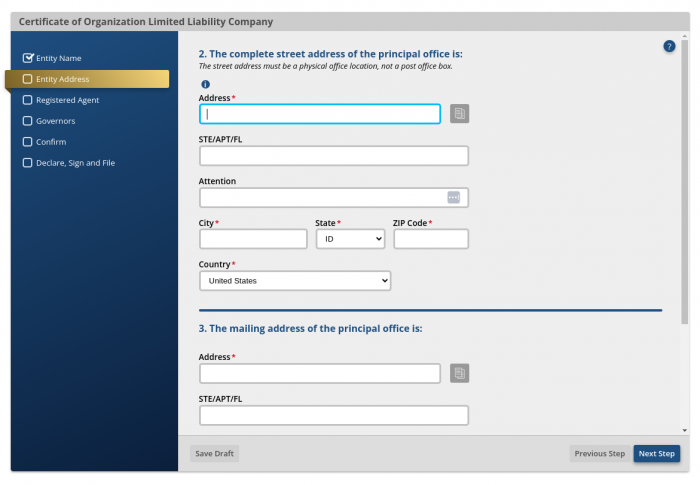

2. Give the address of the LLC’s principal office

This needs to be the physical, street address of your LLC’s principal place of business. You cannot use a UPS Store, PMB or PO Box. If the Secretary of State notices, your LLC may administratively dissolved and revoked.

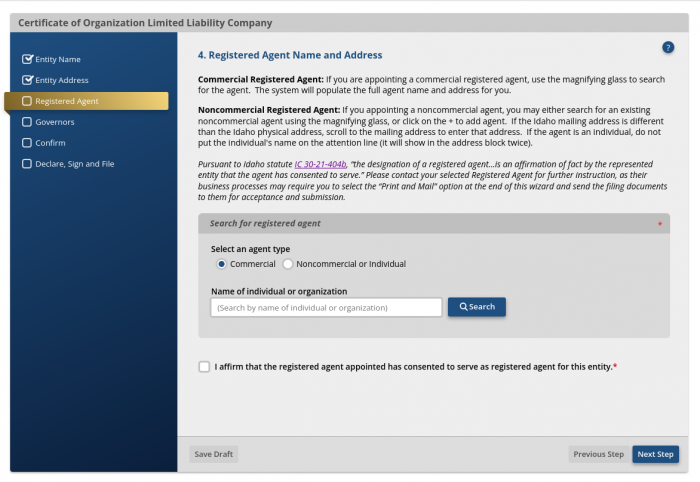

3. Give the name and address of your Idaho registered agent

Idaho law, § 30-21-402, requires all registered businesses to appoint an Idaho registered agent. You can appoint a commercial registered agent like us, or appoint a non-commercial registered agent. If you decide to use a non-commercial agent, you’ll need to choose someone who is 18 years or older, an Idaho resident, and available at the same physical address every business day of the year. Why? Your registered agent is there to accept legal mail on your business’s behalf. Whoever you choose, their name and address will need to be listed here.

For just $35 a year, every year, we’ll let you use our business address on your Certificate of Organization, immediately scan and upload any legal mail we receive on your behalf, and notify you when your annual report is due.

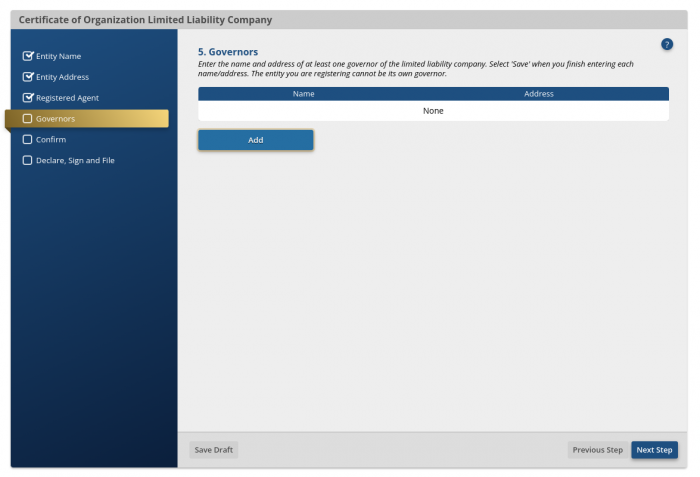

4. Give the name and address of LLC’s governor(s)

Idaho uses the word “governor” for anyone in your LLC who has significant decision-making power (a.k.a. a member or a manager). You need to provide the name and address of at least one of your LLC’s governors.

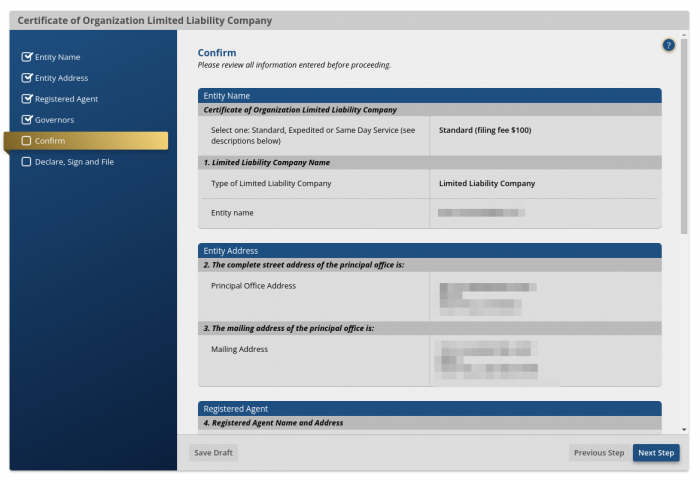

5. Review and an confirm the information on your application.

You will need to review the information on your Certificate of Organization and confirm that it is accurate. If you need to change any information on your application, you can click on any of the previous pages on the left-hand side and make the changes you need.

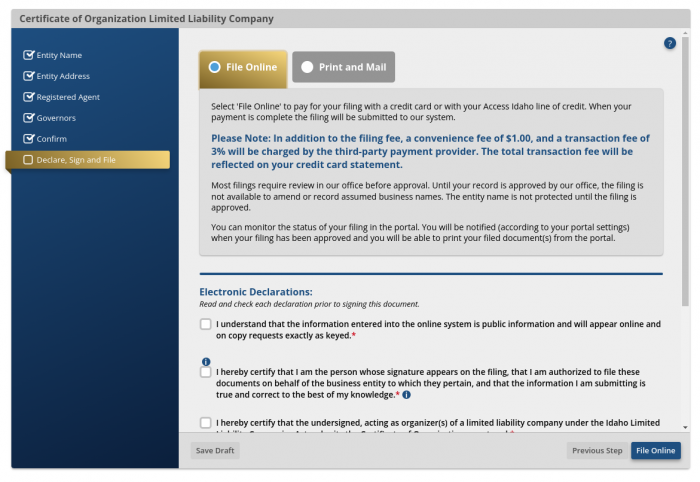

6. Sign and file your ID LLC Certificate of Organization

You’ll finish up filling out your Certificate of Organization by providing a signature from the LLC’s organizer or organizers. Up to two signatures can be included. Once this is done, you’ve completed filling out your Certificate of Organization you’re ready to file it with the Idaho Secretary of State’s office.

If you’re filing online, submit your signature and click the “File Online” button. Or, if you want to submit a paper copy, you can print your application and mail it in yourself.

The filing fee varies depending on which method you choose.

- Online filings can be submitted through the Idaho Secretary of State website. You will pay the $104 filing fee ($100 filing fee + $4 credit card processing fee) online.

- Mail or In-Person filings have a higher filing fee of $120 ($100 filing fee + $20 non-electronic manual entry processing fee) and can be delivered to:

Office of the Secretary of State

450 N 4th Street

PO Box 83720

Boise ID 83720-0080

Maintain your Idaho LLC

Once your Certificate of Organization is accepted by the Idaho Secretary of State, your LLC is officially formed. However, there are a few things you still need to do after creating your business to make sure it remains in good standing both with the state and with the federal government.

Get an Employer Identification Number

An Employer Identification Number, or EIN, is a unique number for your business issued by the Internal Revenue Service (IRS) for federal tax purposes. If you register your LLC with the state, you are required to get an EIN. Filing for an EIN with the IRS is free. For more information, visit the IRS website.

Get Idaho Licenses and Permits

Your LLC may need some additional licenses and permits to operate legally in Idaho. The required licenses and permits vary between different types of businesses, so make sure to check which ones your business will need. Luckily, the state has put together a helpful website to determine what’s required of your LLC.

Keep Up with Annual Reports

LLCs in Idaho have to file a report with the secretary of state every year. Basically, your LLC’s annual report is a way for the state to make sure your business’s information is up to date in case they need to contact you. The report is free to file and is due during your LLC’s anniversary month. So, if you originally formed your company on June 12th, you’ll need to submit your annual report by the end of June every year. Thankfully, when you hire us to form your Idaho LLC you’re enrolled in our Renewal Service and we’ll submit your annual report on your behalf! The best part? You’ll only pay when your report comes due (we’ll notify you). If you decide to file yourself, you can cancel this service inside your client account.

Idaho LLC FAQs

Can I reserve a name for my Idaho LLC?

Yes. The Idaho Secretary of State allows you to reserve a name for your Idaho LLC by submitting an Application for Reservation of Legal Entity Name. This form costs $20 to file. Once submitted, your chosen name will be reserved for up to four months.

How much does an Idaho LLC cost?

At least $104. Online filing fees are the cheapest, costing $100 + a credit card processing fee. The Idaho Secretary of State charges an extra $20 “manual entry” fee on top of the $100 filing fee for paper filings delivered in person or by mail.

You also have the option to pay more to expedite your filing. To get your filing processed within 2 business days you can pay $40. Need it processed the same day? No problem, but it’ll cost you an extra 100 bucks.

How much will my second year with Idaho Registered Agent LLC cost?

We only charge $35 a year for our registered agent service. This service still includes all the perks you had during your first year with us, but at a much lower annual price. Compare that to the $200 fee some of our competitors charge their clients for a second year, and we’d say we offer a pretty good deal.

How long does it take to get my Idaho LLC?

The time it takes the state to process your paperwork will depend on how you submitted your filing. Certificates of Organization filed online usually take 5 to 7 days to process. Filings submitted in the mail can take up to 2 to 3 weeks. For an extra $40 you can expedite your filing so that your LLC is formed in 8 business hours (so usually the next business day), or for $100 you can pay to have your Certificate of Organization processed the same day.

Can Idaho Registered Agent LLC get me an EIN?

We sure can. We’ve submitted EIN applications to the IRS for countless clients. If you’d like us to submit yours, you can add it in your online account after your hire us to form your company or be your registered agent.

Do I need to file an Idaho annual report?

Absolutely. Unlike some other states, Idaho doesn’t charge LLCs an extra fee for filing an annual report late. However, if you fail to file your report within 60 days after your anniversary month, the state may choose to administratively dissolve your company.

Can Idaho Registered Agent LLC file my Idaho annual report?

Yes. Our Idaho LLC formation service includes Renewal Service enrollment for just $100! We’ll make sure your annual report is filed on time, so you don’t have to worry about losing your good standing or other state penalties. The best part? You won’t pay any additional upfront fees! If you’d rather file yourself, you can easily cancel inside your secure account.

Can I cancel services with Idaho Registered Agent LLC?

Yes. We’ll be sorry to see you go, but we understand things change. We’ve made it easy to cancel your services. You don’t have to worry about following a complicated set of steps or an awkward phone call with a pushy sales rep. You can cancel with the click of a button inside your client account. If you want to hire us again in the future, no problem! You can do that with the click of a button, too.